Spotlight on Construction

September 1, 2020

The construction industry is the third largest employing industry in Australia (behind only healthcare and retail trade), with 1.05 million employees (around 9% of all workers) in May 2015. It is the largest provider of full-time jobs in Australia and they are employed by 400,000 businesses, over 90 per cent of which are SMEs.

The latest figures in Australia showed that the gross value added by the construction industry amounted to almost 140 billion Australian dollars. Supporting this, employment in this industry rose to 1.18 million people.

Where are we now?

The Australian construction industry is expected to contract by 5.7% in 2020, due to the twin challenges of the Covid-19 pandemic and drastically low oil prices.

The country’s construction industry has been hit hard by the COVID-19 impact. Despite construction classified as an essential service, meaning 94% of businesses in this industry could still operate, many residential projects were put on hold. Homeowners had become more hesitant to start major projects, with architects similarly reporting widespread project cancellations. The major challenge for the construction industry now is securing new projects in the near future. However, with the construction pipeline beginning to reduce, many in the industry believe there is a significant risk of job losses for those directly and indirectly employed in this industry.

The Australian federal government, as well as the individual state governments has taken steps to offset the weaknesses in the construction industry. The federal government’s ‘Infrastructure Investment Program’, is expected to deliver $79 billion in infrastructure funding through 2026-27, including funding of the $9.8 billion ‘National Rail Programme’ and equity for other major infrastructure investments.

The decline in residential construction, which started in 2019, will be aggravated by the rise in unemployment across the country. Dwelling units’ approvals were already down, contracting by 6.2% during the first two months of the year, pointing to a period of severe weakness in 2020. The downturn will be compounded by rising unemployment and the impact on household incomes and confidence emanating from the Covid-19 outbreak.

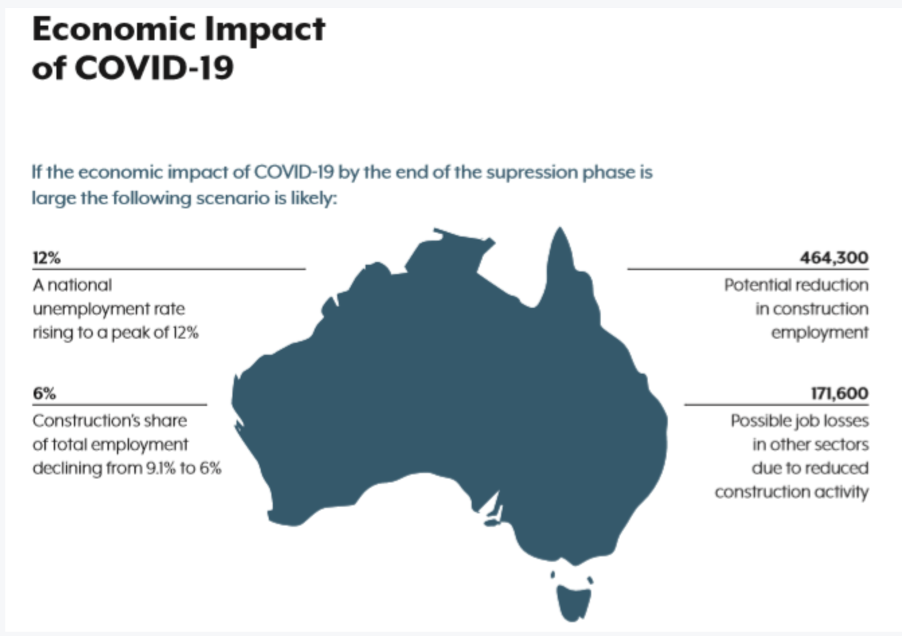

With 1.2 million people employed directly by the construction industry and with research suggesting that a further 440,000 jobs in other sectors of the economy are dependent on construction work, our high impact scenario envisages that 464,300 construction jobs could be lost as a result of COVID-19 crisis, and an additional 171,600 jobs lost in the sectors which depend on construction – a total loss in employment of 635,900.

Challenges facing the industry

Outside of Covid19 challenges that will be experienced the industry has several other major challenges:

- A slow-to-innovate industry

Construction is one of the three industries (together with agriculture and transport) that are slow to embrace digital technologies and innovations (based on a report by the Office of the Chief Economist.

- Projects are most likely to go over time and over budget.

Delays beyond original schedule are a common practice. Large projects typically take 20% longer to finish than scheduled. A typical home is most likely to go 10.6% over the budget of the entire cost

- Issues with productivity

When it comes to productivity, construction still “lags behind” other key Australian sectors, including agriculture and healthcare. PlanGrid states that over 14 hours per week are spent on dealing with conflict resolution and rework that drift away from high priority tasks.

- Ensuring the safety of workers

Safe Work Australia informs that though work-related injury fatalities decreased by 62% from its peak in 2007, construction remains in the top three industries that imposes a risk to workers’ lives (as of 2018).

- Skills and Labour Shortage

Globally, skills shortages in construction affect 27 out of the 46 markets researched (that’s over 58% of the markets).

Industry Outlook

The recovery of Australia’s construction and infrastructure sector from the impacts of COVID-19 is expected to extend over the remainder of the year, with non-infrastructure workloads, headcounts and profit margins all predicted to decline sharply.

The Australian Construction Industry Forum (ACIF) forecasts that the decline in Residential Building will be so deep that it will dominate the outlook for building and construction, dragging down economic growth and employment. Up to 43,000 new homes will not be built in the next 12 months as a result of COVID-19, according to new economic modelling released.

The commercial building landscape is changed hugely by the crisis: private sector-led projects are likely to suffer due to the very uncertain economic backdrop. On the other hand, the public sector dominates important areas of commercial building like health and education and the short term prospects for these are much improved given that government stimulus is likely to be heavy here.

Overall, the huge reverses in private sector investment will outweigh the possible expansions in government driven projects and the commercial building volumes are likely to be quite depressed over the three-year period between 2020–21 and 2022–23. Thereafter, a reasonably emphatic recovery is likely to resume as the economy returns to its long-run trajectory.