Pet Industry Spotlight

September 15, 2020

Australia has one of the highest rates of pet ownership in the world, with over 60% of Australian households owning a pet. Of these, 38% are dog owners and 29% are cat owners. In addition to this, 59% of people who do not currently own a pet admit that they would like to own one in the near future

These pets form an integral part of their owners’ lives, with many considering their pets to be family members

The pet industry in Australia is worth more than $12.2 billion according to a report by Animal Medicines Australia (AMA)

Australia’s pet population consists of 4.8 million dogs, 3.9 million cats, 4.2 million birds, 8.7 million fish + a heap of others

The RSPCA estimates that the average dog costs roughly $13,000 over the course of its lifetime.

Taking into consideration all pet costs, including food, veterinary services and more, then the average dog will cost a household $1,475 per year. For cats, it’s $1,029. However, this doesn’t mean that cats are cheaper, as cats have a minimum expected lifespan of 15 years as opposed to 10-13 years for dogs.

An estimated $490 million is spent on insurance for Australian pets every year.

The Australian Pet Industry

These statistics show the importance of the pet industry in Australia. The Pet Industry comprises of Industry operators and retailers of pets, pet food & accessories, pet services and pet supplies.,

The biggest pet industry suppliers in Australia are:

- Greencross Pty Ltd

- Petstock

- Best Friends

- Pets Domain

- The trustee for Heon Holding Unit Trust

Trends in the pet industry

- Humanisation of pet food – Consumers are turning away from traditional pet foods and looking for healthy ingredients. They are opting for more fresh, frozen and made-to-order diets for their pets. These products cost more and consumers are trading up.

- Increase in raw & organic pet food – further to the above trend, more pet owners are opting for raw diets with an increasing number of Australian manufacturers providing these options.

- Online private brands – Amazon and Chewy.com are promoting their own brands to disrupt the market and eliminate middleman margins. Other smaller, niche players are likewise creating brands with their own identity further segmenting the pet food industry.

- Treats – Pet parents feed their pets 8-10 treats a day and the trends in which treats are succeeding are following the same trends as pet food. Just look at your Instagram feed to see how many suppliers of various treats there are.

- Technology – We are seeing pet services and conveniences developing along the lines of services for people. Just as with people, the smartphone has enabled this change. Fancy toys that provide treats, camera’s to watch your pet while you are work and even gadgets that can throw a ball for them are now available.

- Increased services – There is more attention being paid to pet grooming, pet care, pet transportation, pet hotels, and many others. It is not uncommon to take your pooch to the doggy day spa.

- End of Life – There are a great deal more products and services for pets as they age and pass away. Palliative services for terminally ill pets, pet cemeteries, and cremation, grief consulting are some examples.

- Availability – mass merchants, grocery, and even dollar stores are adding premium pet foods and other products so that it’s available at many more points of distribution than ever before.

- DTC – The direct-to-consumer trend has reached the pet industry in a big way. Many brands are following their human product counterparts and selling products without going through a traditional multi-brand retailer.

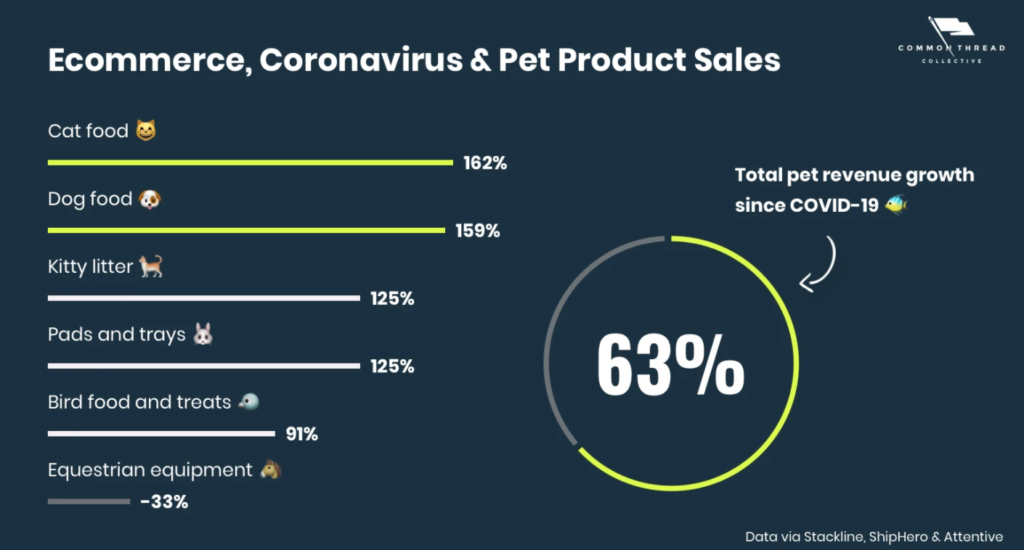

- Increase in e-commerce pet product sales – Convenience and comfort, choice, easy pricing comparisons and devoted focus on customer relationships are threatening the traditional model relied upon by the major industry players clashes with what customers have come to expect in the world of digital. This digital disconnect offers an opening for ecommerce brands to leap up and capture market share.

- Increase in pet adoption – Pet ownership has a positive impact on mental health so an increase in demand for fostering, adopting, and buying dogs has seen an increase during Covid-19

Leading pet industry categories

What happens in the US usually has a trickle down affect here in Australia and the pet food industry is no different. Take notice of the trends and how you capitalise on them moving forward.

Challenges

Like most industries, post Covid-19, some businesses will see sales increase and others will struggle.

Suppliers of traditional pet kibbles and foods are seeing increased competition from new boutique players in the market.

Given the increase in demand for puppies, the prices are becoming very high which provides opportunities for dodgy operators and puppy farms to enter the market. Let’s hope that the industry and consumers are monitoring these and not supporting this horrific practise.

Post covid there is a lot of conversation about the mental health and certainly the benefits of pet ownership and human pet connection have been proven to help reduce loneliness and address social isolation.

As this graph shows there is still plenty of room for growth, especially in the Australian market.