Two-thirds of Australian businesses are still underinsured

January 25, 2021

A new report from Business Australia shows that two-thirds of Australian businesses are still NOT adequately insured to cover natural despite the horror year of bushfires, floods, and a pandemic.

Cost and complexity are two of the biggest factors that impact obtaining adequate cover. Many are overwhelmed by the administration burden of overseeing their policies and tend to just let them roll over each year.

According to Business Australia’s Chief Customer Experience Officer, Richard Spencer, “many were hit by the lazy tax’ in which many rolled over insurance policies without considering changed conditions.”

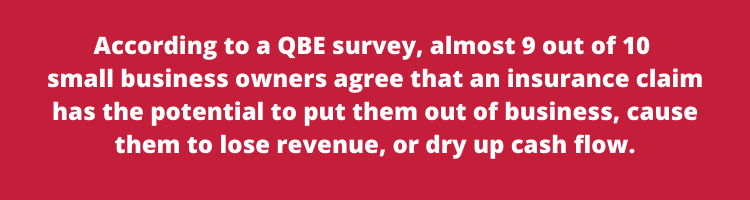

According to a QBE survey, almost 9 out of 10 small business owners agree that an insurance claim has the potential to put them out of business, cause them to lose revenue, or dry up cash flow.

Despite this, insurance is often paid without putting too much thought into it. Many businesses put it into the too hard basket, even though it has a huge impact on the livelihood of their business.

Aaron Gavin, the General Manager of Small to Medium Enterprises (SME) at QBE Australia, says that when business owners think of insurance, they tend to think more of their tangible assets, like the business property or electronic equipment first.

“It’s important to understand all the risks your business faces to ensure you’re protected should someone bring a compensation claim against you for an event connected with your business, even if that incident is not your fault. This can include a customer being hurt on your business premises, a competitor claiming you stole their ideas, or a customer claiming a breach of privacy.”

Mr Gavin said that talking to SME’s highlighted the need for liability insurance, with QBE liability claims data revealing the 10 most common liability incidents that can impact your business, along with the 10 most expensive liability claims:

So how do you know if you are underinsured?

Insurance helps you to manage risk if something happens to you, your property, or business and helps you recover from the difficulties and financial hardship caused by unexpected events that cause injury and/or a financial loss. It is about protecting yourself from a loss from which you wouldn’t otherwise be able to financially recover.

Underinsurance happens because some people don’t properly value their assets. You can minimise your risk of being underinsured by taking some sensible steps.

If you are underinsured, it means you have paid for an insurance policy that doesn’t cover the full cost of your potential loss or the financial impact on yourselves and your family or business.

The actual amount of claim is determined by the formula:

Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum.

How to avoid Underinsurance

Calculators: Talk to your Rivers Insurance Broker who has access to re-building calculators & can provide you with a report detailing a replacement or rebuilding cost so that you can make a more informed decision about your insurance sums insured. HERE is a calculator to help you work out the cost to rebuild your house

Review yearly: Review your cover every year to ensure you are adequately covered in the event of an unexpected catastrophe occurring.

Resale value vs Re-building value: Understand that the real-estate value of your property is not the insurance rebuilding value. Consider the cost to rebuild your existing property.

Asset Register: An itemized asset register or inventory list with replacement values is a great way to understand the true value of possessions & to keep track of your contents sum insured.

Understand your policy – Make sure you understand the insurance product you have chosen by carefully reading the Product Disclosure Statement, which sets out the policy that your insurer supplies.

Understand the terms – You need to know that the difference between a total replacement policy and a sum insured policy. Also understand the difference between defined events and accidental damage.

Speak to the experts: Speak to people who live and breathe insurance and understand what you need and what should be included in your policy. This can save you thousands of dollars and a lot of unnecessary stress if anything is to happen.

Next steps

If you are not sure if you have the right insurance for your business, it is important to check. If 2020 has shown us anything, it is that you need to be prepared for anything.

Book a FREE Insurance Consultation with one of our experienced insurance experts. Call us:

Brisbane: 07 3028 9494

Cairns: 07 4051 8422

Innisfail: 07 4061 1766